What 2023 Holds For The Fintech Industry

After 2021’s bumper year of progress, 2022 was a disappointment for the global fintech industry. You could be forgiven for thinking that the sector’s heyday was over, as total funding volume to private companies fell 46%. Public companies weren’t immune either. Share prices tanked across the board, as even giants like PayPal and Block (previously Square) suffered drops of around 60% through the year.

One result was widespread layoffs, from companies big and small. Plaid, PayPal, Stripe and Chime were just some of the big names that let people go, and that trend further cemented the gloomy outlook in many people’s minds.

However, the situation is more nuanced than this evidence suggests. Fintech is a segment of the broader tech industry, an industry that suffered more than others amid a global economic slowdown. That was partly due to disproportionate highs the year before as the world turned to digital solutions during the pandemic. The exceptional growth was fuelled by low interest rates driving more money into venture capital as investors sought higher returns.

From this perspective, 2022 was an adjustment in the fintech industry’s trajectory, a correction if you will. Which leads to the question: what will we see in 2023, as economic conditions remain uncertain?

Related reading: The biggest challenges for Fintech in Africa in 2024

Slower Growth, Greater Customer-Centricity

Fintech companies are adjusting their growth forecasts, and not for the better. Three factors are at play. First, no easy money to finance rapid expansion. Second, the resultant reduction in people-power. And third, the fact that many areas of the market are overcrowded – think (buy-now-pay-later (BNPL), digital banking and banking-as-a-service (BaaS) to name but three.

These revised forecasts aren’t necessarily a bad thing. In numerous cases, growth was prioritised over efficiency and sustainability, resulting in questionable product and service quality. Not to mention regulatory missteps. The reported volumes of fraud at neobanks is one example of this phenomenon, another is companies launching products they don’t have right permissions for (for example, Robinhood’s attempts to launch a payment and savings account in 2018).

Now, fintechs need to reassess — margins are everything and they cannot afford to lose customers or pay regulators’ fines. They need to keep the customers they have happier, while pacifying regulators which are increasingly showing an interest in their activities.

That should mean increased customer-centricity, with products and services tailored and honed to meet customers’ needs — even as those needs rapidly change in-line with the economic environment. Account providers need to help people budget and save, lenders need to help people afford repayments.

This operational readjustment will mean less impressive customer acquisition and possibly revenue numbers, but don’t panic. If it comes alongside a more considered approach to running a business, including greater focus on customer wellbeing, the result will be more structurally sound companies with healthier profit margins.

More Mergers and Acquisitions

Not all private companies will make the required adjustments to survive in 2023’s tougher environment. One where going to investors for another sizable handout is no longer an option, while customers have a vast array of other options. Some of these organisations will have been planning on an IPO, but for most the conditions no longer seem favourable. (Although there will be exceptions, including Stripe and its rare peers.)

Fintech organisations unable to raise capital as planned will therefore have fewer options. The result? Almost certainly a greater volume of mergers and acquisitions (M&A) in the fintech industry than was seen last year as companies paused exit activity while waiting for the dust to settle.

More forward-thinking banks are likely to already have a shopping list together, ready to spend the profits they are making from increased interest rates. They will seek products and technologies to enhance their own offerings — whether that’s in customer-facing areas or the back office.

Another group of companies likely to have the available capital to participate in M&A are insurers. And while tech companies have woes of their own (Google laid off 12,000 people in January), they still have deep pockets and eyes for a bargain.

The result will be a slimming down of the sheer number of fintech companies out there, but that won’t mean less competition. The organisations which do the merging and acquiring will be in better positions to effectively serve customers.

A Fraud Detection Boom

Fraud not only affects incumbent financial institutions but is also a significant challenge for newcomers, despite their more modern technology stacks — and it’s only going to get worse in 2023.

The cost-of-living crises occurring globally are making retail customers in particular more susceptible to certain types of fraud, such as non-existent investment schemes that promise sky-high returns or those offering ways to save money on utility bills. There has also been a notable uptick in Authorised Push Payment (APP) fraud, which relies on convincing customers to authorise a transaction to a criminal’s account either via hijacking bank security, or “conditioning” the customer.

Regulators are aware of this, and making noises about the responsibility for preventing customer losses or reimbursing them if they do occur sitting squarely with banks. Understandably that is making financial institutions nervous.

At the same time, banks are repeatedly being fined for regulatory breaches in areas such as Know-Your-Customer (KYC) and Anti-Money Laundering (AML) compliance. Globally, the volume of such fines went up by 50% in 2022 versus 2021.

All of this points to 2023 being a year for increased investment in fraud detection and prevention fintech by both VCs and financial institutions — despite both groups’ pulling back innovation spending almost everywhere else. There are signs this trend is already underway, with early 2023 seeing significant rounds raised by a number of fintechs already.

2023 — a year for reassessment

Where the fintech industry has mostly enjoyed good times since its emergence proper post-2008, 2023 is going to be a test. We will see a new definition of what “successful” means for businesses, which will impact which existing businesses survive and which new companies find their feet.

Inevitably we will see some companies fall by the wayside. While sad, this isn’t necessarily a bad thing if the most customer-centric, efficient businesses are those to survive. And we will see the dominant areas of fintech make room for newer areas that align with societies’ changed priorities.

Forget doom and gloom. 2023 will be a busy one for the fintech industry, and one I’m certainly looking forward to.

NEXT UP

Tammas Ryan, Head of Customer Service at Edrolo: “The disruption caused by AI is likely to impact offshore customer service operations”

We interview Tammas Ryan, Head of Customer Service at Edrolo, a company providing teaching resources for teachers in Australia

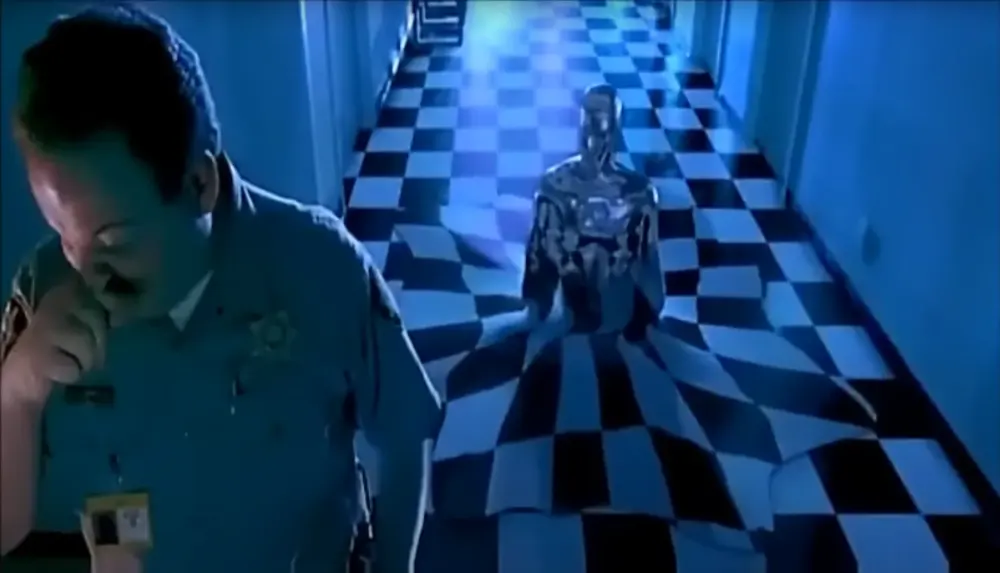

Terminator 2 in 2024: liquid metal and soft robots are here today

Metals which stay fluid at room temperature aren’t a science fiction invention. In this T2 revisit, we explore liquid metal and soft robots.

Oracle to expand cloud and AI footprint in Japan with $8 billion investment

Oracle has announced that it will invest more than $8 billion over the next decade in cloud computing and AI in Japan.