Top ten breakthrough fintech companies of 2023

Despite the apparently depressing funding environment, all is not doom and gloom in the fintech industry. Companies big and small are still raising funding — Stripe’s $6.5 billion round at a valuation of $50 billion anyone?

They’re making waves in other ways as well, from relative unknowns partnering with international social media networks to beating the banks at their own game. With that in mind, here’s my roundup of the top ten breakthrough fintech companies of 2023 (in no particular order).

Related reading: The biggest challenges for Fintech in Africa in 2024

eToro

Hear me out. While the Israeli eToro is well-known to avid followers of the “stock picking” and crypto trading segment of fintech, having been founded in 2007 and achieving unicorn status in 2020, it has recently been catapulted into the mainstream spotlight. That’s thanks to the unexpected decision by Elon Musk to choose it as Twitter’s partner for offering investment services to users.

There is an, admittedly unusual, method in Musk’s madness. eToro was one of the first digital investment services to offer “social trading”, a technique whereby the investment decisions of “top” investors are made available to others, who can then choose to copy those decisions. Less experienced or less confident investors get a helping hand, and often the top investors get remunerated.

Given the number of people who use Twitter as a primary source of information, the partnership makes sense.

Teya

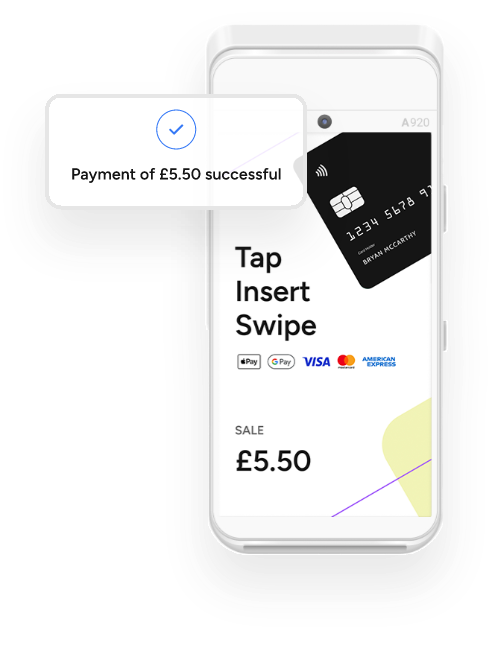

UK-based Teya, formally known as SaltPay, was founded in 2019 and for two years it remained very much under the radar. During that time it focused on providing payment services, acquired a significant number of other companies (six in 12 months), expanded to 15 countries and accumulated 300,000 customers.

Now, under the new brand, Teya has relaunched with a bang as a “one-stop solution” for European businesses. It offers a range of services in addition to its core payments provision including a digital loyalty platform, website builder and merchant account features.

It may have started quietly, but I expect Teya to be firmly on the radar from this point onwards.

Yonder

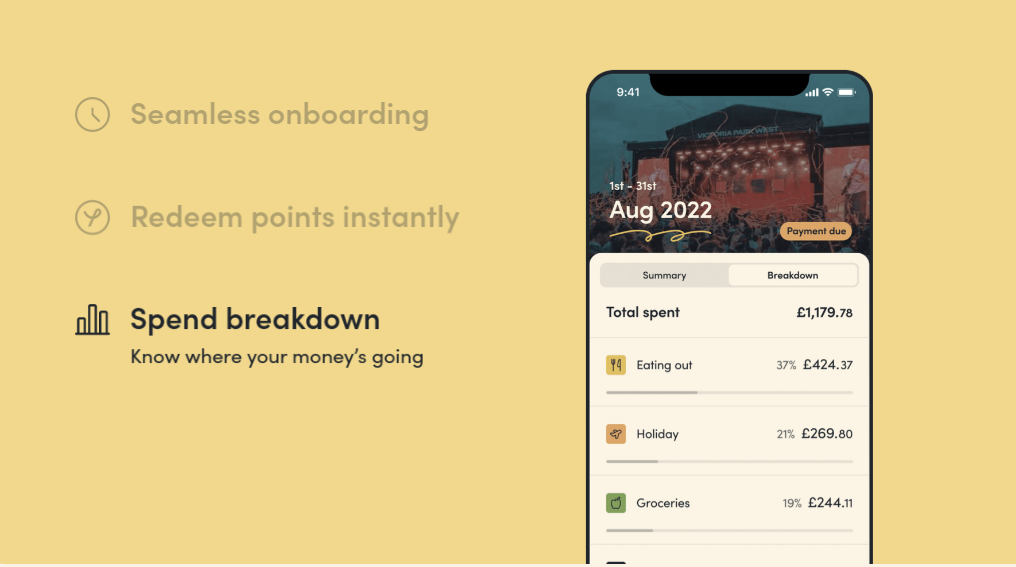

Founded in 2021, the UK-based credit card provider recently raised a combined £62.5 million in equity funding and debt facilities. Despite the success of homegrown fintech account providers and neobanks, to date, the UK has sorely lacked innovation in the credit card space.

Yonder plans to upset that status quo with its product targeting “young professionals”, which offers rewards that can be redeemed in major UK cities on lifestyle products and services. For example, meals in the most talked about restaurants, digital detox retreats and upmarket cinemas.

If it can tread the fine line between a fee-based card and quality rewards, Yonder might be the next Amex.

Wahed

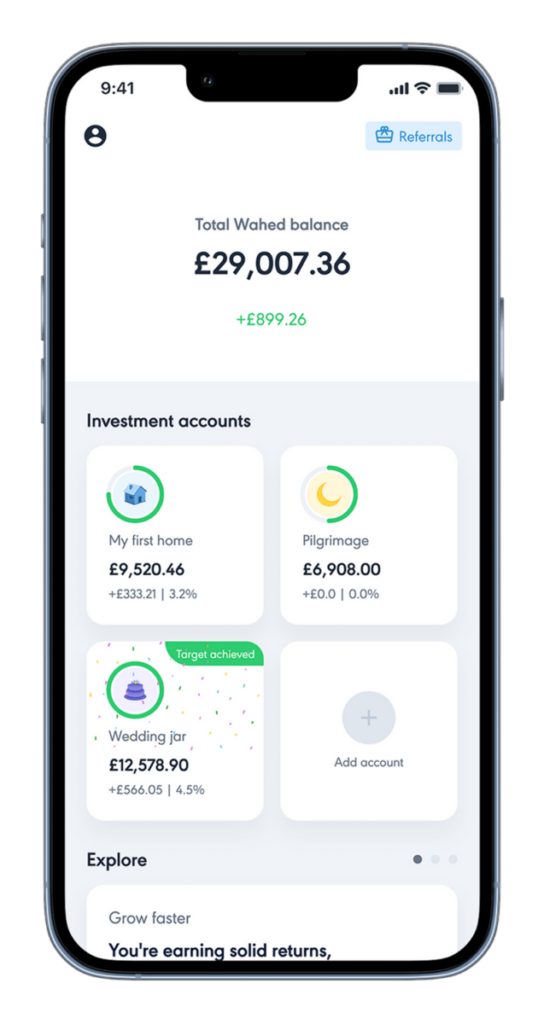

The NYC-headquartered, sharia-compliant investment platform was founded in 2017 but firmly established itself this year when it opened a physical branch in London after raising $50 million in 2022.

Alongside its investing products, Wahed offers a Halal will-writing service following its acquisition of iWill Solicitors in February 2023, and recently launched a gold-backed debit card product.

Given the size of the Muslim population in the territories in which it operates (UK, US, Malaysia and UAE) Wahed is targeting a huge market — its next step is to foster trust in formal financial services among potential customers, something the new branch is designed to accelerate.

Moov

This US company is a payment processor at heart, enabling its customers to do things such as accept card payments, make payouts and issue cards. However, it’s different to traditional providers of such services as you need only connect to it once via an API.

This makes life much easier for end customers and is a large part of the reason Moov managed to garner $45 million in January 2023 when the fintech funding landscape, especially for later-stage rounds, was in serious drought. Having made a splash via that raise, the platform will use the investment to scale and capitalise on the ongoing banking-as-a-service (BaaS) trend.

Flutterwave

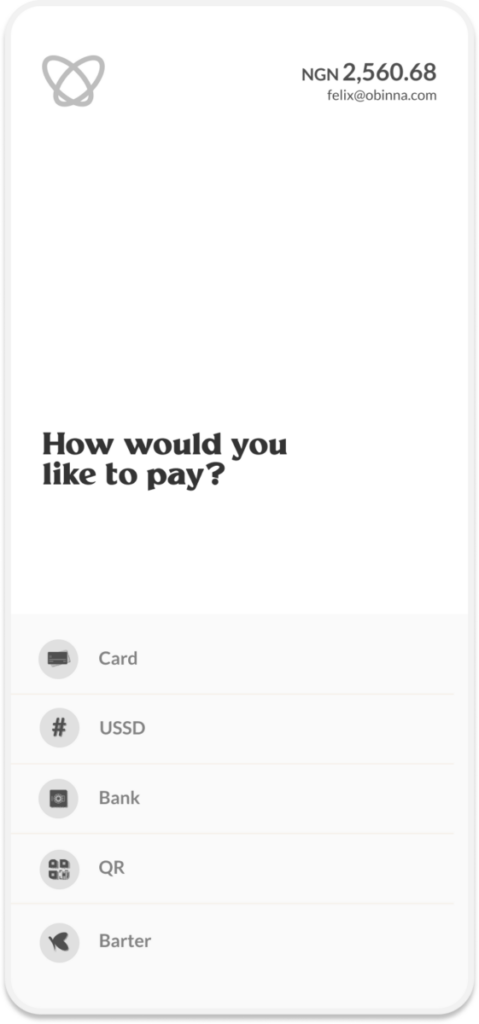

By recently making the news in the UK for its expression of interest in acquiring failed BaaS provider Railsr, the Nigerian payments company gained attention outside of its home market and eroded its position as “the biggest fintech people have never heard of”.

But that depends on where you live: Flutterwave is extremely well-known across Africa. It’s in Europe and the US that awareness of this provider of financial services to businesses, including credit, payment card issuing and e-commerce solutions, had been somewhat lacking.

As companies such as Wise and Uber start working with Flutterwave to expand their offerings across Africa, and with further expansion plans now public if the Railsr conversation was anything to go by, expect to hear a lot more about the company on the wires.

Zopa

Zopa is another potentially unexpected entrant on our list of breakthrough fintech companies of 2023. Originally founded in 2016 as a peer-to-peer (P2P) lender, the company has since turned itself into a bank, receiving a full licence in 2020. From there, it built out its banking products and services and worked on acquiring customers until it achieved profitability in 2022.

While profitability for fintechs is not the be-all and end-all that many media outlets suggest, it’s a mark of how well Zopa did establishing itself in an adjacent business line and in the UK banking market.

Investors seem to agree, with the company being another of the lucky few receiving Series B and above rounds in early 2023, winning £75 million in February. Given its plans to use that cash for acquisitions and a potential IPO, Zopa’s place as a leading digital-only bank is confirmed.

Kroo Bank

Receiving its banking licence in 2022, the UK-based digital-only bank made mainstream headlines at the end of that year when it launched a market-topping interest rate of 3.03% on its savings accounts. Then, in February 2023, it was recommended by Martin Lewis of MoneySavingExpert, firmly marking its arrival on the UK banking scene.

The only problem: it wasn’t necessarily ready for this further boost in attention. Assuming those hiccoughs are resolved, and that it can balance keeping savers happy with making returns on its lending products, it’s likely to become an ever-growing presence.

Greenwood

The US fintech that provides banking services to black and Latinx communities launched in 2020 with a hugely respected group of founders and backers.

However, despite having raised three funding rounds, it only opened to the general public in April 2023 after dedicating time to onboarding the 500,000 customers on its waitlist. Since then it has picked up the pace, announcing the acquisition of another fintech serving the same communities just two weeks later.

The need for specialised banking services is especially strong in the US given the gulfs that exist between provisions for different groups, and with its cautious approach and passionate leaders and investors, Greenwood is well placed to help meet that need.

Kita

Founded in October 2021, the UK-headquartered carbon insurance provider has gone from strength to strength since becoming a Lloyd’s of London cover holder in December 2022. It went on to be nominated for the Earthshot prize and raise £4 million in seed funding, both in February 2023.

Its success is partly due to it operating in a space that is both a subject on everyone’s lips and one of huge importance — reducing climate change. It does that by enabling businesses to purchase carbon removal credits with lower risk, encouraging more of them to do so. That’s a market that’s only going to grow, and one which Kita appears to be very well positioned to target given its trajectory so far.

Read more from Sarah Kocianski: Why CFO tech is so damn hot right now

NEXT UP

What is the one key thing employees expect from technology when they start their working day?

Regardless of industry, working location or applications used, employees should expect technology to just work.

Let the games begin: Paris Olympics puts AI to the test

The Paris Olympics will drench the French city in AI – but care must be taken to avoid any harm

Jochem van der Veer, Co-Founder and CEO of TheyDo: “In this world of AI, we need to remember to think humanely”

We interview Jochem van der Veer, Co-Founder and CEO of TheyDo, who shares many excellent insights into how businesses can make their customers happy