Klarna, Buy Now Pay Later and first-mover advantage: an analysis

The company got to profitable growth by cementing its first mover advantage and doubling down on retailer relationships but faces competition from incumbent giants. Independent analyst Viggy Balagopalakrishnan delves behind the headlines

Loans, that let consumers borrow money at an interest rate and thereby afford very expensive items like cars or homes, have existed for a long time. Buy Now Pay Later (BNPL) is a more recent phenomenon with a few key differences: it is meant to incentivise customers to make medium-size purchases like laptops or expensive clothes, is interest-free, and has a shorter period (around two months). It’s an “interest-free” loan as long as you pay it back on time.

Klarna, one of the leaders in the Buy Now Pay Later market, had an impressive earnings announcement last week — it got to its first-ever month of net profit while growing revenue by 17% year-over-year. Its biggest competitors, Affirm and Afterpay, continue to be unprofitable.

What’s impressive about Klarna is that despite not much product differentiation, it has successfully managed to double down on its first mover advantage and turn that into a profitable growth machine. Looking forward, though, the company faces some competition and regulation risks that could change the trajectory of how much market share it ends up owning in the long term.

In this article, we’ll dive into:

- The Buy Now Pay Later (BNPL) market

- First-mover advantage in a non-differentiated market

- BNPL criticism and regulation

- The non-competitor competitors

The Buy Now Pay Later (BNPL) market

The mechanism of how BNPL works is something like this:

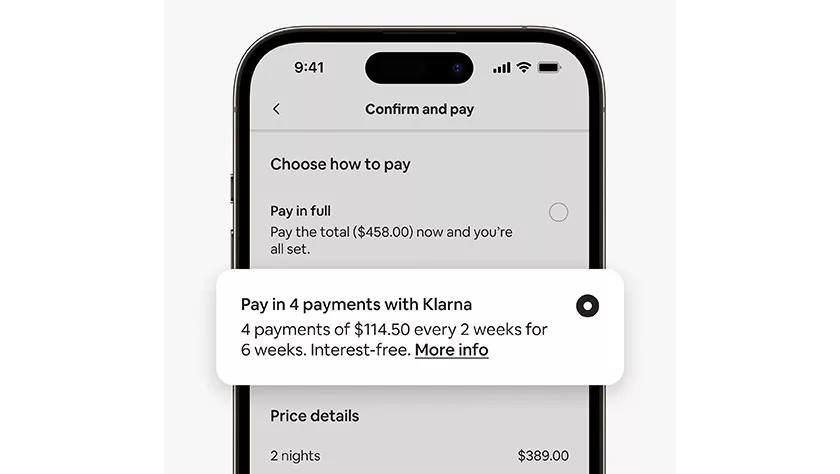

- A company like Klarna offers to split your $1,000 MacBook purchase into four payments of $250 made every two weeks

- That’s a less jarring commitment than having to pay $1,000 upfront, which means you are more likely to buy (and therefore Apple likes it too)

- Klarna “borrows” money from somewhere and gives you essentially what’s an interest-free loan

- You pay Klarna back on time

Now, let’s look at the economics across this sequence of events:

- Klarna borrows money from somewhere at a cost to lend this to you; it gets this money either from a bank (at an interest rate north of Fed’s 5.25-5.5% rate) or from customer deposits held with Klarna’s high-yield savings account (4%+ annual interest rate)

- Retailers are bought in on Klarna’s ability to drive more purchases by improving affordability, so they pay 2-8% of transaction value in fees to Klarna

- Klarna aims to make sure that consumers who borrow money don’t default, and when they do, the company charges non-trivial late fees (up to 25% of order value)

The economics have generally worked out pretty well for Klarna. It has an impressively low 0.41% credit loss rate (i.e. money lent out that’s not collected back) compared to around 2.3% for consumer bank loans. While consumer late fees do contribute a meaningful part of its revenue, roughly 85% of its revenue comes from retailer fees, and overall the company is profitable. In other words, Klarna can borrow money at a cost, offset the cost through commission from retailers + some late fees, collect most of the money back, and at the end of this be profitable.

In addition to being able to do this profitably, there are a few factors that make this market uniquely attractive.

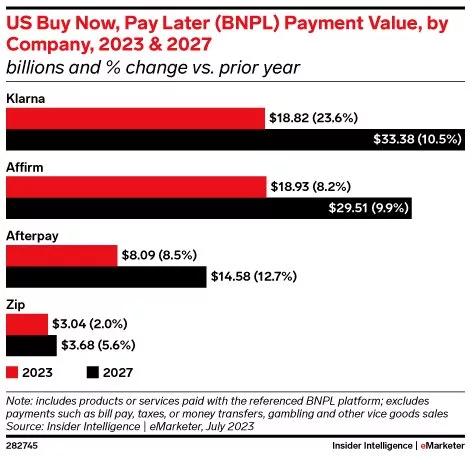

First, all companies in the BNPL market, both profitable and unprofitable, continue to have steep growth rates in GMV (gross merchandise value). Klarna grew 14%, Affirm grew 26% and Afterpay grew 19% year over year. These three major players together account for circa $3 billion in annual revenue of what’s potentially a $100+ billion market, i.e. there is a large addressable market and everyone is getting a piece of the piece.

Second, the market is currently owned by a few players that continue to grow steeply year over year, pointing to a clear first-mover advantage trend. Afterpay first found success in the Australian market and became the dominant player there before expanding into the US market. Klarna started with the UK market and had tremendous success owning that market before expanding into the US. Affirm, founded in the US, made inroads in the US market before getting acquired by Square/Block, which has given it newfound momentum.

While it is to be seen where the market share among different players lands in the long term, the first-mover advantage is clear and is primarily explained by a lack of differentiated product offerings.

First-mover advantage in a non-differentiated market

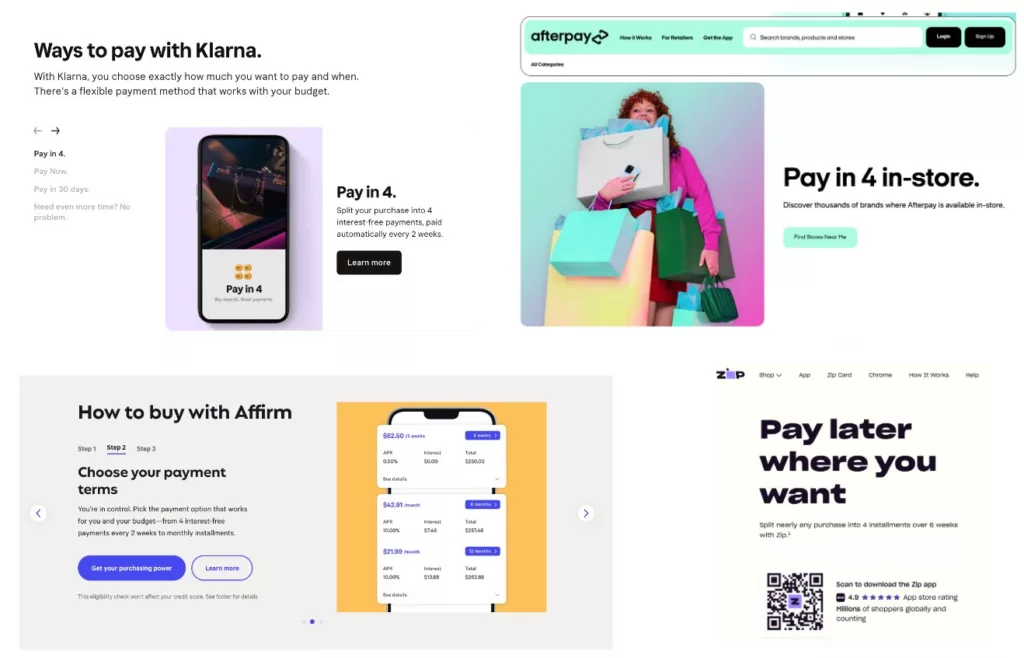

All the BNPL products have very similar product offerings — that is, pay in multiple instalments. Klarna provides some additional versions of this (like pay in 30 days) but the core value proposition is the same as its peers.

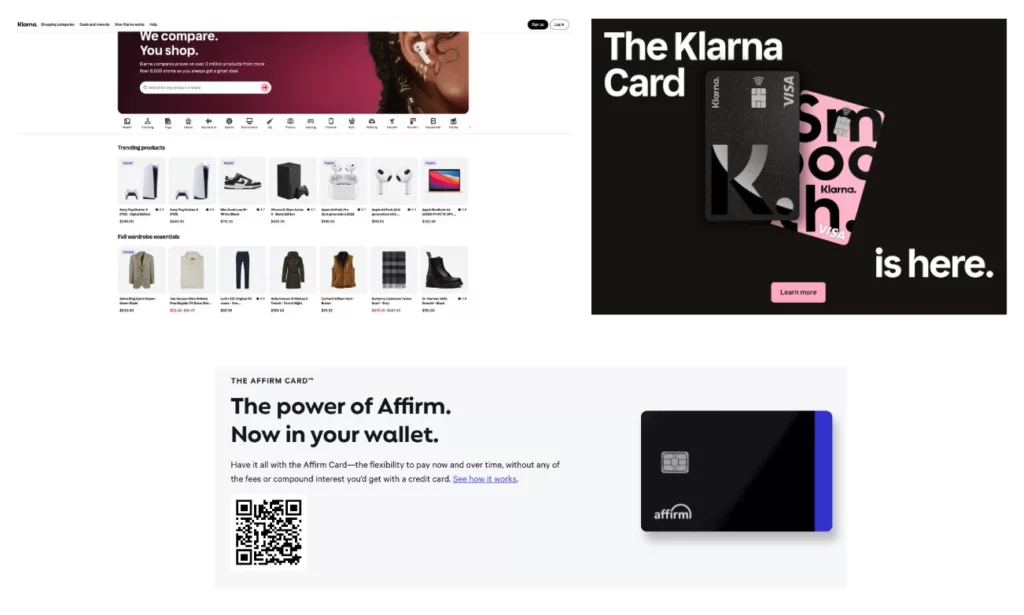

Klarna has tried to build differentiation through new product experiences including a shopping/discovery experience that lets consumers find products they might love, and the Klarna Card (Affirm launched a card of its own as well) but these are still early in the adoption cycle and not a core part of its business.

Therefore, the crux of Klarna’s growth strategy has been cementing its first mover advantage through a combination of building brand awareness with consumers and expanding retailer relationships. Klarna today operates across 500k+ retailers (including around 79k physical stores). It is a supported BNPL partner for several large brands in the US including but not limited to Instacart, Groupon, Samsung, Etsy and Fossil to name a few. Notably, in May this year, Klarna announced that it will now support flexible payments for Airbnb bookings and is continuing to push into the travel market, which has come back steeply after the pandemic.

While the company has been able to execute the first mover strategy so far, there are a couple of important headwinds that Klarna needs to navigate to stay on its growth trajectory — regulation and competition.

BNPL criticism and regulation

Buy Now Pay Later companies have faced a limited amount of regulation so far, and this has particularly helped them grow in less regulated markets like the UK and Australia. The lack of regulation has given the companies much more flexibility to operate and compete against traditional lenders and credit card companies — ranging from less strict requirements around checking borrowers’ eligibility, to simpler disclosure requirements while signing up. Some existing laws do apply to BNPL but are much less strict than the regulatory requirements for traditional lenders and credit card companies. There is also no specific law regulating BNPL in the US, which has been one of the fastest-growing markets for Klarna.

The Consumer Financial Protection Bureau, which is the US government agency investigating BNPL, published two reports — one in 2022 and another in 2023 — which provide deep insight into this market using actual data reported by BNPL companies.

Let’s look at some interesting usage trends from these reports:

- BNPL usage for “everyday” or “necessity” purchases (gas, groceries, and utilities) increased from $43 million in 2020 to $229 million in 2021, i.e. trend towards less discretionary spending

- The borrower base skews young, but more toward Millennials than Gen Z

- Those with at most a high school degree were less likely to use BNPL than consumers with at least a bachelor’s degree

- Black, Hispanic and female consumers and those with $20k-$50k household income were more likely to use BNPL compared to white, non-Hispanic and male consumers, or those with household income <$20k

- General-purpose credit cards charge a 22-24% interest for consumers who haven’t paid their balance in full, and consequently, BNPL is attractive to consumers, particularly ones with lower credit scores who might have more egregious credit card rates

All of this data screams “responsible borrowing”. Despite all the criticism for BNPL, it’s reasonable to infer from this data that the consumers benefiting from BNPL are precisely the ones that were most expected to benefit: generally responsible and well-informed consumers, who want to use this as credit for reasonable purchases and don’t want to risk being charged predatory interest rates by credit cards.

Not to say there aren’t risks to BNPL. The report includes a few data points to back this up:

- 10.5% of borrowers were charged at least one late fee in 2021, up from 7.8% in 2020

- Around 25% of BNPL users and non-users alike have zero credit card liquidity (i.e. they are maxed out on their credit cards), but 6% of BNPL users compared to 3% of non-users have negative credit card liquidity (i.e. their credit card debt is higher than their credit limits)

- BNPL borrowers exhibit measures of financial distress that are statistically significantly higher than non-users (eg. higher credit card debt and utilisation, higher likelihood to overdraft, higher likelihood of revolving on at least one credit card)

In simpler terms, BNPL regulation essentially comes down to protecting the small percent of users who might already be in a financially vulnerable position, and who might be taking on BNPL without fully understanding the obligations. The Consumer Financial Protection Bureau has laid out what it considers the three primary harms, and has signalled that it wants to regulate these:

- Direct consumer harm from practices like lack of clear disclosures, complex dispute resolution, and forced autopay

- “Data harvesting” which specifically includes leveraging customers’ buying data to recommend other products, and customising user experience through “font, colour scheme, word choice, user flow order, etc.”

- Overextension risk, i.e. borrowers take out several loans within a short time frame + sustainable usage affecting their ability to pay back

The first and third risks seem reasonable, and I agree with the argument that guardrails are required to protect the minority of consumers who might be more vulnerable. The data harvesting argument, however, is grasping at straws — the bureau is saying that BNPL companies cannot customise a product recommendation feed/app experience using purchase data, in an environment where banks unscrupulously sell our data. This feels like a complete double standard, and even on a first principles basis, the risk here seems theoretical without much evidence to back it up.

Based on the recent announcements in the UK and US, it is likely that some regulation is coming, and it could involve treating BNPL as credit. This would open up BNPL companies to stricter compliance around disclosures, how they market their product to consumers, and reporting borrower repayments to credit bureaus. While these might temporarily slow them down, I’m not convinced any of these risks are major. The core value proposition of BNPL is resonating with consumers, which makes me bullish that Klarna can successfully navigate the regulatory landscape.

The non-competitor competitors

The bigger risk facing BNPL companies is competition, given their highly non-differentiated product offerings. Klarna has primarily been competing with other BNPL companies (Afterpay, Affirm) in the past few years, and has managed to grow successfully through a combination of brand awareness and scaling up retailer relationships.

While that has set Klarna up for growth so far, its biggest competition going forward will be from existing payment players in the US market, who already have stronger brand awareness and distribution.

In March this year, Apple announced that it is piloting Apple Pay Later with a subset of consumers. Apple essentially has free distribution to every iPhone user in the US and Apple Pay has the brand awareness/trust to take market share overnight. PayPal also has a Pay in 4 offer that mimics Klarna and its BNPL peers. PayPal again has both brand awareness and distribution to gain market share, particularly in eCommerce. Several retailers also have their own financing products/credit cards and I would expect these products to start providing BNPL options as well.

Conclusion

Klarna’s first month of profitability is an incredible milestone and a strong proof point that it can continue to grow while being profitable. Investing in brand awareness and retailer partnerships has helped Klarna cement its first-mover advantage. The regulatory risks ahead of them might be smaller but the competition risk from big players like Apple and PayPal is non-trivial. Given the early stage of the BNPL market, I’m optimistic Klarna will own a meaningful share in the long term, but it’s to be seen whether the company continues to maintain market leadership in the face of competition with the big giants.

This article was originally published on the 9th of September in the author’s weekly newsletter, Unpacked.

Keep up with the latest business trends

NEXT UP

Eight lessons from building an AI product

In 2021, long before ChatGPT, Prashant Mahajan built his own generative AI tool for product managers. Here, he shares his playbook for building an AI product that will stand out from the crowd.

Taavi Tamkivi, Founder and CEO of Salv: “Collaboration between financial institutions, or rather lack of it, has traditionally been a challenge”

We interview Taavi Tamkivi, the Founder and CEO of Salv, a regtech company on a mission to beat financial crime

Apple AI iPhones move one step closer with on-device AI experiments

Apple AI iPhones are a distinct possibility with the release of experimental language models that could run easily on a phone